Last month, I chose to strip away all the hubris around AI and ask one simple question, one that oddly no one had really bothered to ask; how much revenue is needed to justify the current level of capex spend and give AI investors a return on their capital??

I clearly hit a nerve in the industry, when judging by the number of individuals who reached out to chat. Since then, I’ve spoken with people who own datacenters, lend to datacenters, and design datacenters. I’ve spoken with people who are working to improve the cooling technology, or the customer interface. I’ve spoken with hedge fund, PE and VC investors who are fixated on the future of AI, and I’ve spoken with employees who are desperate for a liquidity event before it all collapses. In total, I’ve spoken with over two-dozen rather senior people in the datacenter universe, and there was an interesting and overriding theme to our conversations; no one understands how the financial math is supposed to work. They are as baffled as I am, and they do this for a living.

This is one of those rather surreal situations where everyone senior in this ecosystem knows that the math doesn’t work, but they don’t know that everyone else also knows this. They thought that they were the foolish ones, who simply didn’t get it.

As a result, my blog post seems to have elicited a liberating realization that they weren’t alone in questioning the math—they’ve just been too shy to share their findings with their peers in the industry. I’ve elicited a gnosis, if you will. As this unveiling cascaded, and they forwarded my writings to their friends, an industry simultaneously nodded along. Personal self-doubts disappeared, and high-placed individuals reached out to share their epiphanies. “None of this makes sense!!” “We’ll never earn a return on capital!!” “We’ve been wondering the same thing as you!!”

Yet, no one outside of this insular industry seems to have had their own awakening. Investors in particular seem oddly asleep at the wheel; fixated on the rate of improvement for LLMs, and oblivious to how the economics of all this will work.

Part of what makes writing this blog so rewarding, is the feedback I receive from those who know an industry, like datacenters, better than I ever will. I really do appreciate all critiques, and it would be intellectually dishonest if I didn’t share those critiques as they cluster into two core misinterpretations on my part.

To start with, I had previously assumed a 10-year depreciation curve, which I now recognize as quite unrealistic based upon the speed with which AI datacenter technology is advancing. Based on my conversations over the past month, the physical datacenters last for three to ten years, at most. Changes to cooling systems, chip and racking designs, power systems, and even overall layouts, mean that the buildings themselves are likely depreciating quite rapidly as well. Then when you consider that new GPU iterations, which seem to come out every year or two, effectively obsolete prior models, you realize that I should have been using a much faster depreciation curve across the whole capitalized structure.

However, if you speed up the depreciation curve to something in the three to five-year range, it would imply that my prior breakeven revenue number of $160 billion to justify 2025’s capex spend, is woefully inadequate. In reality, the industry probably needs a revenue range that is closer to the $320 billion to $480 billion range, just to break even on the capex to be spent this year. As I wasn’t educated on the intricacies of a datacenter, I wasn’t bearish enough on the economics of an AI datacenter. No wonder my new contacts in the industry shoulder a heavy burden—heavier than I could ever imagine. They know the truth.

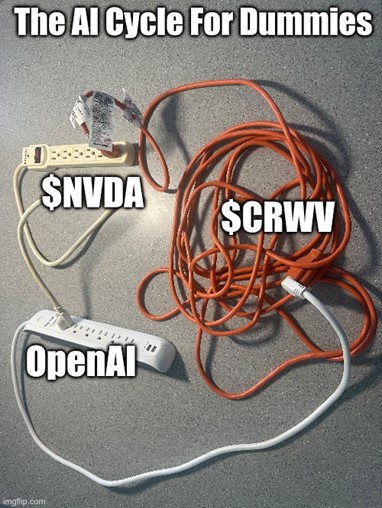

Remember, the industry is spending over $30 billion a month (approximately $400 billion for 2025) and only receiving a bit more than a billion a month back in revenue. The mismatch is astonishing, and this ignores that in 2026, hundreds of billions of additional datacenters will get built, all needing additional revenue to justify their existence. Adding the two years together, and using the math from my prior post, you’d need approximately $1 trillion in revenue to hit break even, and many trillions more to earn an acceptable return on this spend. Remember again, that revenue is currently running at around $15 to $20 billion today.

The other core critique of my blog post, was assuming that anyone in this industry wanted a return on their capital. The hyperscalers have a long history of subsidizing money losing businesses, as they bring customers into their ecosystems to purchase other products—maybe AI is just another of these money losing ancillary businesses?? While it’s easy to discredit the notion of losing hundreds of billions on a side-hustle, the tech industry does have a long history of ignoring current economics and simply plowing ahead. Besides, the government may ultimately stand behind this spending for national security reasons.

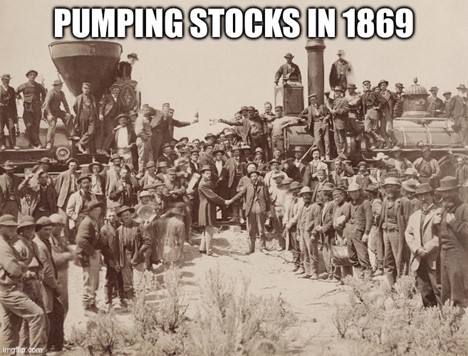

Think back to the building of the transcontinental railroad. For strategic reasons, the government wanted to connect the coasts, and realized that subsidies would be needed. The government tried all sorts of tricks to accomplish their goal. There were land grants and cheap loans. Laws were ignored, and founders were allowed to siphon funds. The unity of purpose superseded all else, and the nation was better off for having accomplished the goal of completing the transcontinental railroads. It’s obvious that the government wants the US to win in AI, and maybe the government really does sit there, fully prepared to ensure that American AI dominates globally. Then again, the 1800s had multiple financial panics caused by the railroads going bankrupt. Much like AI, the economics simply didn’t justify building multiple transcontinental railroads, especially when the railroads then competed transport rates below operating costs.

I thought it was odd how many AI industry insiders brought up the railroads as a good proxy for why the AI buildout must continue, without mentioning that the railroads all went bust, multiple times, along the way—with these busts often leading to multi-year global financial panics.

I did speak with one fund who pointed to a far rosier view of the potential for AI, where the revenue ultimately grew into the capital spending. However, to get there, the revenue came from displacing highly skilled workers. If you assume that the global economy spends trillions of dollars on highly skilled employees, then AI could potentially disintermediate these individuals and capture their salaries, justifying its existence. While I see this as partly inevitable, I also recognize that it’s also years into the future. Today’s tech just cannot do what will be required of it (AI shouldn’t be dispensing medication when it can’t even count to 7). While I recognize that one day we’ll have AI doctors, AI tax returns, and AI lawyers, I don’t think that they’ll be powered on the current generation of datacenters—that will be long after today’s tranche of GPUs grows obsolete.

So, I return to my initial question; when will the pending loss on today’s AI buildout have its realization moment?? This then leads to a larger question; if the railroads failing led to global financial panics, what does that tell us about a similar outcome if AI cannot be monetized at anywhere near its cost??

Think about the railroads in the second half of the 19th century. When they failed, it wasn’t just the collapsing bonds held by investors, often pledged as collateral for other loans, that pulled down the economy. It was also the inability of the railroads to raise additional capital to order new steel and railroad ties, along with the thousands who got laid off at railroad yards and locomotive manufacturing plants. Then, there were huge multiplier effects to all of this. Railroads became dominant, not just to the financial system, but to the real economy as well. They became so important, that they would become responsible for periodic and deep economic depressions every time they experienced funding stresses.

How big is AI to our economy?? Let’s use some abstract math that is likely to be rather imprecise, yet directionally credible. From a starting point, let’s work with my $400 billion capex estimate for 2025. Now add in some unallocated corporate expense, some R&D, some spending on new electricity generation capacity, plus some other expenses, and the AI buildout likely represents approximately 1.5% of expected 2025 US GDP of approximately $30 trillion. Now, nothing economic happens in a vacuum. Every dollar spent has a multiplier downstream in other industries to support this spend. Is it irrational to expect that with a bit of a multiplier, AI capex is clocking in closer to 2% of GDP?? Which is a good chunk of total expected US economic growth this year. Actually, without the AI buildout, the US economy would probably be teetering on the cusp of a recession (which certainly mirrors the view from many of the industries that I track).

Now, the math gets a bit trickier when contemplating the Wealth Effect engendered by all of this. While much has been written on this topic, I don’t think anyone really knows how to calculate or quantify it. What we do know, is that roughly half of all spending comes from the top 10%, frequently those who have appreciating assets. While we have no idea how much of this spending is driven by those appreciating assets, anecdotally, I believe that when assets appreciate, the propensity to spend also increases. Furthermore, much of the equity appreciation this year is coming from the handful of stocks tied to the AI sector, while the real economy stocks mostly suffer.

Would it be crazy to say that the equity side of the AI bubble is driving a 2% increase in GDP through additional consumption?? Could it be 3%?? What if it is as much as 5%?? No one really knows, and this is all highly speculative as a thought exercise, but could the 2% of GDP tied to the AI buildout be padded with a few hundred basis points of Wealth Effect spending as well?? What if the AI capital misallocation bubble is responsible for more than 100% of the economic growth today?? What if it’s budgeted (using their own public guidance) to be an even larger percentage of GDP growth in 2026??

Railroads and AI are actually quite similar, they’re absolutely massive capital projects, with huge financial implications for investors. Much like with railroads, if the funding for AI slows, the buildout slows. If the buildout stops, the shares of the AI beneficiaries get sold off, and the Wealth Effect goes in reverse. Consumption growth goes negative, and you get a financial panic that reverberates through the entire economy in a feedback loop. Except unlike railroad tracks and locomotives, which have long useful lives, AI datacenters go obsolete almost immediately—they’re complete write-offs. The capital destruction will be massive.

Now, I’m not here saying that the AI buildout ends tomorrow or even next year. My cohort of experts was almost universal in noting that power contracts drive spending, and long lead items have been ordered for delivery dates that are years into the future. In many ways, as long as there’s enough capital that wants to invest in AI, there’s line of sight for the next few years of AI datacenter buildout, even if the numbers make no sense. It’s simply too expensive to cancel a take-or-pay contract with an electric utility. As a result, my concerns aren’t today concerns, they’re tomorrow worries. However, finance has a certain way of allowing problems to fester, before they explode into the open, a Minsky Moment if you will.

What would this look like in real time?? If you think back to the fiber-optic bubble of 2000, the warning signs were obvious. When the capex spending started to outstrip the desire of investors to fund it, the vendors started to act in irrational ways in order to hit Wall Street targets. Lucent and Nortel started lending their customers money to buy networking equipment, they took equity stakes in their customers, so that they could purchase more equipment, and they even bought capacity on their customers’ fiber-optic networks so that their customers could show revenue growth, and hit Wall Street targets. All of this was done in the hope that their customers could raise more capital to keep buying networking equipment. As you can imagine, when you’re the vendor, the customer and the investor in a company, there’s a strong incentive to artificially inflate the numbers by signing preferable contracts that use very large numbers, and then round-trip the capital. With extreme pressure to hit targets, especially as the funding cut off, it should be no surprise that this led to endemic fraud at both Lucent and Nortel, ultimately leading to their collapse.

Knowing my financial history, and the fact that these things tend to rhyme, I’ve been somewhat mesmerized by the recent spate of announcements amongst a handful of companies that seem to be simultaneously buying, selling and investing in each other. It feels like something that I’ve seen before, especially as the numbers are absolutely massive—so massive that they cannot be meant as actual financial commitments, but rather to generate investor attention. Now, I want to be clear when I say that I have zero evidence that anything illegal is happening here. Then again, something about this does seem to rhyme. It feels like the money is starting to run out, and they’re starting to become more desperate to gin up new AI investors—hence, the reason that I’ve started to fixate on this AI topic. The numbers involved are massive, but that is irrelevant to the timing of when this implodes. Like all bubbles, it implodes when people get tired of funding it.

In summary, AI is something to keep an eye on. We have a template of prior buildouts as a roadmap, from railroads to the fiber-optic buildout in 2000, from the canal bubble of the 1830s, to the power plant bubble of the 1920s. If the economics don’t work, doing it at massive scale doesn’t make the economics work any better—it just takes an industry crisis and makes it into a national economic crisis. Like many things in finance, the outcome remains obvious, it’s the timing that is the hard part…

DISCLOSURE: Funds that I control have a small collection of bearish wagers on AI

The Pause…