This post originally appeared in KEDM on June 4, 2023…

“We originally spoke about Argentina back in October of 2021 and said to put it on your radar. We think the time has now come to load up.

Let’s start with the obligatory note that we love Argentina; friendly people, beautiful countryside, great wine. We’ve been there a few times and are fans. More importantly, it’s always been stunningly cheap to visit. Doug Casey famously says that “Argentina is the cheapest civilized place on earth,” and we agree. Given the current (persistent) currency crisis, we assume that it’s even cheaper to visit today. However, this isn’t a tourist guide. The listed securities are also cheap, unusually cheap, stunningly cheap. Why are they so cheap?? Well, that should be obvious, the country is bankrupt, the currency is effectively worthless, they owe money to every global acronym, and the economy is in shambles. Fortunately, most of this is fixable. There’s Western infrastructure everywhere, the roads are paved, things actually (sorta) work. The problem is simple; for the past century, the Argentines have chosen insane people to run their country. That’s it. That’s the whole issue. The government is the problem. Fix the government and you fix the country.

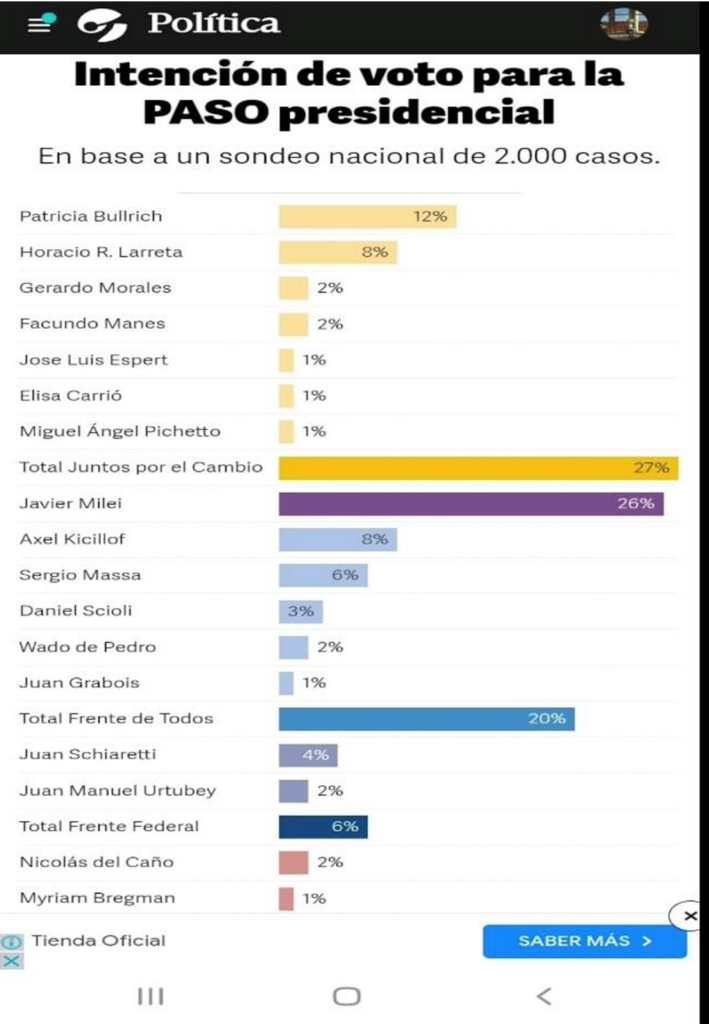

Of course, having tasted the wonders of socialism, the Argentines have been slow to abandon it. However, once you hit rock bottom, literally rock f*ckin’ bottom, things start to change. There’s an election this October, let’s look at the latest polling numbers.

Since there’s roughly zero likelihood that you recognize any of these candidates for the primaries, here’s what you need to know. Yellow is Macri’s party. He made a mess of things when he was in power (more below) but he’s a free-market guy who thinks that more capitalism is the solution. Purple is Javier Milei (who’s the focus of this posting and likely winner of the election), he’s right of Ron Paul in terms of his libertarian ideals. Finally, you have the Socialists at 20% of the vote, and then a scattering of stray candidates here that don’t matter. The key is that 53% of the vote is going to the libertarians or extreme libertarians. Here’s another poll (we’re following a few of these as they’re all of questionable quality).

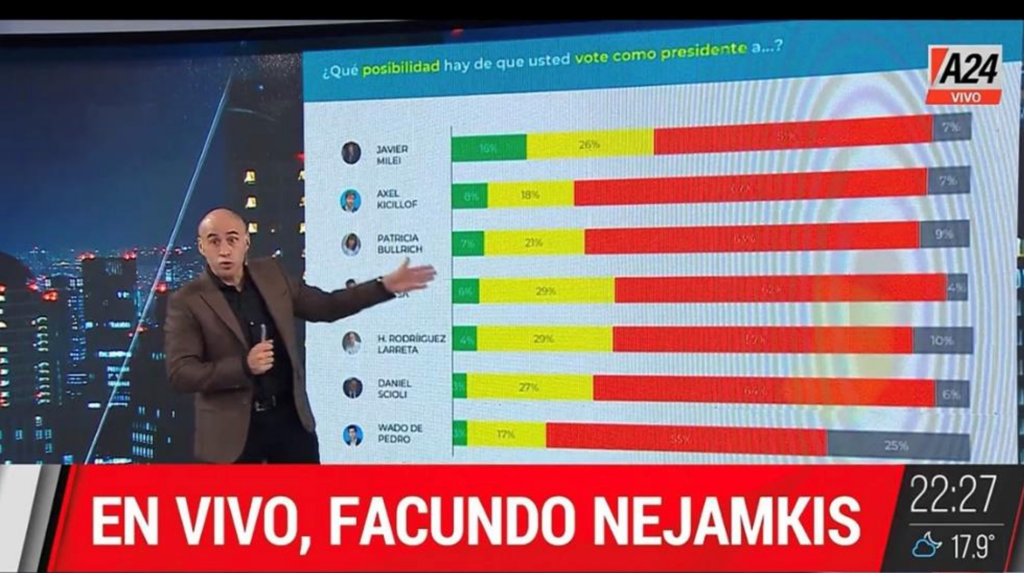

See all that Green, that’s Milei. The Socialists are in 2nd place, but look at all the intense dislike in red. Then Bullrich and Larreta from Macri’s party. The Socialists are no longer popular. That’s the point here.

What’s happened?? It’s simple. The Socialists ran the car into a ditch, poured lighter fluid on top of it, called in the IMF and then lit a match. People are ready to try something new. More interestingly, while the older folks like their handouts in rapidly depreciating currency, the younger guys are far more likely to hate the Socialists and support the Libertarians. This is the opposite of most countries where people age and grow more conservative. This is a unique set-up that may have legs.

Going back to the election mechanics here; dozens of candidates are competing in the primary on August 13 to lead their party. Then each party runs 1 candidate in the general election on October 22. Based on current polling, it will be Milei against either Bullrich or Larreta from Macri’s party, going up against a Socialist candidate that is unlikely to win. Then if no one gets 45% of the vote on October 22, the top two candidates battle it out on November 19. In our minds, we’re looking at an election between Ron Paul (Milei) and Ronald Reagan (Bullrich) here.

So, let’s look at the only 3 candidates who are likely to make it to the final election, starting with Milei who’s said on multiple occasions that he plans to “blow up” the Central Bank.

Here’s his platform.

-Eliminate the Central Bank and Dollarize the economy, while eliminating fx restrictions

-Drastically reduce taxes and regulations

-Impose drastic cuts on retirement and pension expenses

-Privatize state-owned companies that are unprofitable

-Eliminate many of the price caps and export tariffs that hold back the economy

-Privatize the health care system

-Reduction of employer’s taxes on labor and eliminate severance payments

-Eliminate most of the government employees

We can keep going, but you get the point. He’s a self-professed anarcho-libertarian and he has called his remedy to the current crisis, the “chainsaw plan.” As you can imagine, we’re a bit enamored with him. Next up is Patricia Bullrich. What does she stand for? Well, she basically stands for the same things, except she wants to unleash her “shock therapy” over a few months, as opposed to the first day, as she feels that the whole thing will detonate if it’s all done at once. Keep in mind that the election isn’t even about what should be done, it’s about the speed to do it. She is also really focused on her anti-crime and pro-gun stances, which have resonated with voters due to accelerating crime in the large cities—though Milei also likes guns. Finally, there’s Rodriguez Larreta. He’s the current mayor of Buenos Aires and something of a technocrat, which is rarely a good thing. We don’t think he advances out of the primaries and if he does, he’s more of a center-right US-styled Republican. As President, we think he’d be fine, and the market would like him as he’s very well-spoken with the right plan. We simply distrust technocrats, and he’s our 3rd choice here.

Let’s go back to the last time things looked up in Argentina. On October 25, 2015, Mauricio Macri did surprisingly well in the first round of the elections and the market gapped up dramatically. We’re going to use Grupo Galicia (GGAL – US) as a proxy for the market, as it is the largest bank in Argentina (we’ve circled the election win below). Note that the shares had trended higher into the election, only to gap higher afterwards and more than triple over the next 2 years, before the wheels came off (it’s Argentina after all). This is the same trade that we’re flagging here as well. Buy before the first round of the elections (yet since the primaries are so important this cycle, we’re buying before them instead).

So, the trade is easy to understand, Argentina lurches to the right economically, tries to fix the economy, and assets moon. Is it really that simple?? We think so. The only difference this time is that we’re starting from roughly half of the price level in terms of valuations.

Before we talk about a few names, it’s worth speaking about why the wheels fell off during Macri’s presidency. To start with, removing subsidies and letting prices move to free-market levels creates pain and voters decided that they didn’t like pain, which led his economic plan to become mired in politics. He also wasn’t helped by Cristina Kirchner, the former President, who continued to use her voting block in Congress, the Senate and at the provincial level to undermine Macri’s plans. Props to her, as she played her cards well and came back into power—though she wrecked the country in the process. However, we think that things may be different this time (yes, famous last words). The country has hit rock bottom and polling data shows that the people are favoring the more extreme economic treatment candidates. Once again, this election isn’t about what should be done, as polling says that the majority favors doing the Austrian libertarian thing—instead the election is about how fast to do it…

So, how are we playing it??

To start with, we recognize that in a highly inflationary market, standard metrics like income and balance sheet entries have no relation to actual facts. We also recognize that US Dollar debts are scary, but since foreign creditors cannot collect on them, they’re sort of irrelevant too. In many ways, it’s a financial house of mirrors when you analyze the various companies. As a result, we’ve focused much more on prosaic metrics like market cap to hard asset value, and simply ignored the rest. Hopefully, after the re-set, the past few years of data won’t matter much anyway.

We’ve also built quite a broad basket as we want to play the trend, as opposed to any individual company. With that said, here’s our basket in alphabetical order; BMA, CEPU, CRESY, GGAL, IRS, LOMA, PAM, YPF. We don’t own VIST, but it’s also a viable and liquid candidate.

As you’ll note, we basically bought all of the liquid GDRs. We’re underweight banks as they’re black boxes of depreciating Pesos. We’ve also avoided the ARGT ETF as it’s 21.5% MELI and full of Chilean and Colombian assets as well. From here, you’re on your own to research the political candidates and the companies themselves.

However, we’d be remiss if we didn’t note that by far, our largest position in Argentina is YPF. They own half of the Vaca Muerta, which appears to be the second-best shale asset in the world. As you can imagine, a 51% owned government entity, without access to capital or modern equipment or export pipelines or even sufficient sand to really frac a well is a subpar business. If the elections go as we think they will, we think capital floods into Argentina, and that access to capital will dramatically accelerate the ability to advance the project using modern technology. Additionally, Milei has been clear that he’ll privatize the government’s 51% stake to pay off debt, which should help to re-rate the asset further. We liked this idea so much, that we even swapped some of our BNO for YPF over the past week, and you know how much we love oil here…

That said, we’re playing this trade as a basket as this is still Argentina, and bad things happen to good companies.

Of course, we look to the charts for confirmation when we play one of these trends. Look at that YPF strength as oil prices melted over the past year…

As you know, we like big, elongated bases that are waking up. Look at a chart of CEPU, the electric utility. It’s finally taking out the top of the base and has successfully topped the price when Macri lost in 2019.

Or look at IRS, which is a dominant owner of commercial property, mostly in Buenos Aires. It also is at the top of the base and seems to be waking up…

Once again, please do your own work. Recognize that we’re the very definition of Macro Tourists here in Argentina, and also recognize that these are trades, not investments. However, we wanted to get you a look at this before the PASO (primary) on August 13.

Finally, to show that we’re going to be balanced, here is the best bear thesis we know of…

While Milei has since denounced the WEF on many occasions, we still worry that he’s just a Trojan Horse so that the IMF gets paid back…”

The Fed Is Fuct…