On China: Why the Real Risk is CNY 5, Not 9

In Macro investing, it’s critical that I have a roadmap of where we’ve come from and where I think we’re going. Of course, many things in Macro take far longer to play out than my chosen investment timeline of rolling three-year periods. That means that much of my roadmap is somewhat outside the immediate scope […]

On Playing Gold…

Last year, I wrote Part 1 of The Great Macro Dreamscape (Part 2 is coming). To summarize, my view is that the coming decade will be the best of times if you can trade and profit from Global Macro, or the worst of times if you’re a peasant trying to survive the Global Macro. Since […]

Bad is Good

We learned from from Zimbabwe that paradoxically, Bad is Good when it comes to the stock market.

Know Your Enemy

Whenever someone takes the other side of my trade, I want to put myself in their shoes. Is this a worthwhile opponent with a differentiated view?? Am I stepping into a trap?? Or are they doing something for totally uneconomic reasons?? I need to know my enemy. “Yes, I know my enemiesThey’re the teachers who […]

The Blowoff

Last summer, I was having lunch with a friend at a plain vanilla shop, who kept checking his phone and muttering, “this NVIDIA is killing me.” After the third time in five minutes, I had to ask: Me: You run a long-only fund. You don’t short. How is NVIDIA killing you? Him: Kuppy, you don’t […]

2023 Position Review

It seems that everyone has a blog these days. Once a year, we must stop everything, tally up the scores and see who got it right. Besides, what’s the point of going through all this effort, if you cannot point to the scoreboard, and flaunt it a bit. With that preamble out of the way, […]

Just Smash the Buybacks

Great!! Another E&P that raised the quarterly dividend by two cents. Who F*cking Cares!!?? The debate about buybacks vs. dividends has been going on for over a century. I’m not here to try and change your mind. I can see the relative merits of both, especially as many buybacks have been undertaken at insane valuations, […]

Argentina Update

It is said that Argentina has an economic crisis roughly every decade, and it seems to last for approximately ten years… In a previous posting, I noted that the upcoming Presidential election could upset that tradition. Both Milei and Bullrich represented very different and uniquely positive paths for Argentina. As a result, I was long […]

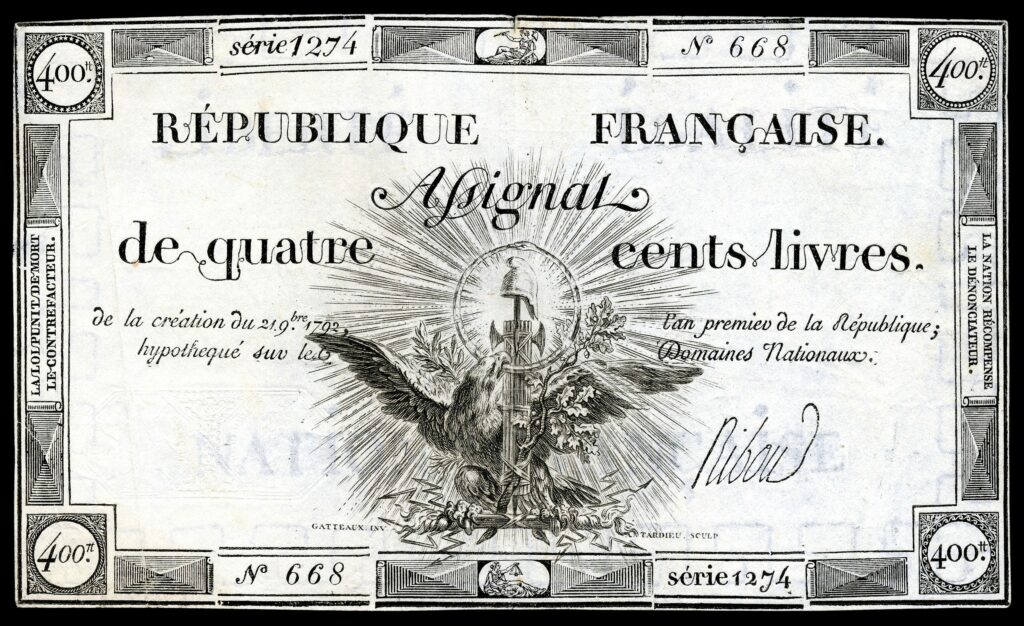

The Great Macro Dreamscape Part 1

In late March of 2020, one of the greatest wealth transfers of my lifetime began. It remade our world—or at least it remade my world. Those who recognized Covid as a hoax, were there to reap the rewards. Others who cowered in fear, were my victims. While I pressed the accelerator on exposure and risk, […]

Kuppy and Mike Alkin “Uranium” Interview at the 2023 World Nuclear Association Symposium

Harris “Kuppy” Kupperman sits down with Mike Alkin, CIO and Founder of Sachem Cove Partners from the floor of the 2023 World Nuclear Association (WNA) Symposium to discuss how attending this conference has opened both of their eyes to the unique mindsets that pervade the nuclear power industry. Filmed September 8th, 2023, in London. At […]

The Bigger Short

The Big Short has become a cult classic movie amongst finance guys. Of course, we all know how the story ends, so there’s no suspense. Instead, the movie is a tale of hubris, and the downfall of a bunch of smug guys in suits. Meanwhile, our heroes are the handful of Wall Street misfits who […]

Playing Inflation Part 2

Warren Buffett famously told investors that if they wanted to prosper during periods of inflation, then they needed to buy companies with high returns on capital and pricing power. As a result, it should be no secret why a company like Coca-Cola (KO – USA) trades so richly—it’s being priced as an inflation resistant Treasury, […]