On Riding Freight Trains…

I have a friend who’s a reasonably competent trader. He’s the type who draws his voodoo lines everywhere on the charts. He caught the trendline break on Bitcoin around $9,200. He expected some resistance around $10,000 and sold out for a quick score just below the figure. He then got the breakout at $12,000 and rode […]

Stop Shorting “Project Zimbabwe”

I have spent a lot of time on this site speaking about “Project Zimbabwe” as this period is so poorly understood and if you get it wrong, I think you’ll get annihilated. I have also written about how it’s getting strange out there as stocks no longer seem to have floors or ceilings on valuations. The moves are increasingly […]

My Favorite Ponzi Scheme…

Let’s set some ground rules here. As far as I’m concerned, Bitcoin is a Ponzi Scheme. If you think Bitcoin is the future of money, a store of value or any other nonsense, I’m not going to disagree with you. Every good scam needs vocal and loyal apostles. Go out and spread the gospel—you have […]

“Project Zimbabwe”

Roughly a month ago on the afternoon of Sunday, March 8th, Fed Chairman Powell had an (fictional) emergency staff meeting. Powell: I want the nuttiest money printing plan ever. What action plans do we have that are prepared and ready to initiate? Admin: Well, we have this one named “GFC 2.0” Powell: Sounds tame and sedate. Won’t impress […]

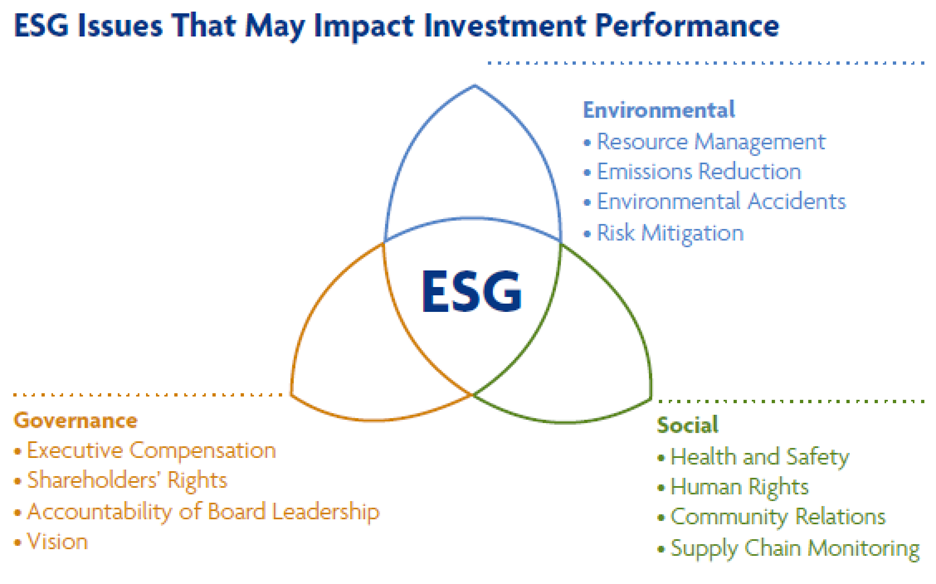

ESG = Excessive Share-price Growth

Two months ago, something rather monumental happened, which seems to have been lost to the news-cycle. In a world starved for yield, a company with trailing twelve-month free cash flow of $527 million (cash flow from operations – maintenance cap-ex) and net debt of only $593 million could not re-finance debt due in 2022. Sure, […]

Kuppy’s Book List

Over the years, I’ve read hundreds and hundreds of great books. Clearly, I cannot recommend them all. The following is a short selection of the better books on investing and general interest. I’ve put ** next to the ones that I most highly recommend. You’ll notice that there aren’t many pure investment books–this is because […]