As a long-time inflection investor, I’ve learned that many themes simply do not inflect. There are multiple causes for this; often tied to a bad thesis, or a bad set of assumptions. Sometimes, it’s simply bad luck as some other macro trend supersedes my trend. Even when I get it wrong, there is often still some level of inflection—it’s just that the strength of the inflection is insufficient to create much equity value. In these situations, I rarely lose much money and frequently even exit with a slight gain—which is why the inflection strategy is so damn powerful.

Meanwhile, a healthy number of my inflection themes just power through. Sure, there are unexpected wrinkles. Sometimes, things take longer to play out, or play out in ways that I did not anticipate. However, they eventually play out, and I get my multi-bagger return—complete with plenty of entertaining surprises along the way. Said simply, a rapidly inflecting trend tends to power equity prices and while there’s plenty of volatility and second-guessing during the ownership period, the upward slope to share prices gives me clear feedback, telling me that the thesis is intact.

I bring this all up, as occasionally, a theme does much better than I had expected. Often this is caused by some unexpected event that I could not have possibly predicted. This event then serves to dramatically alter my thesis for the better. Often these unexpected events are sudden, coinciding with a rapid acceleration in the prices of securities, as others come to understand the magnitude of what is happening. For whatever reason, those situations that initially trended better than my underwriting tend to continue to positively surprise me. They just have this sort of reflexive energy that continues to reinforce both the strength of the trend and the ultimate amplitude.

Now, these situations where things exceed expectations are exceedingly rare, but when I find one, I just know I have a winner—it’s merely a question of timing. As a result, I tend to max it out as the risk is so low and the upside so great. Meanwhile, the longer it takes to play out, the worse the imbalances become and the greater the ultimate payoff.

I do a lot of investing in industries that are tied to supply and demand of some commodity or service, as I have found supply and demand to be one of the most basic concepts, yet one of the hardest for Wall Street to accurately model or price. This is because most investors, even most participants in that industry, anchor their expectations to the recent range of prices. Even the most bullish prognosticators rarely think that something can exceed a narrow band of outcomes, as for most of their careers, such thinking has proven accurate. They simply cannot foresee tail scenarios. When these scenarios do arrive, even the industry participants tend to get caught unprepared—many of them getting run over by events.

Fortunately, for a successful investment, I don’t have to predict the ultimate peak price. All I have to know is that there is indeed a supply and demand imbalance. From there, I need to then predict future imbalances and understand the drivers on both the supply and demand side. Are there new sources of supply? Is there an expected change in demand? Are there price levels that lead to switching, on either the supply or demand side? I basically ask myself what can adjust my math. That’s all I need to know. Whereas most investors fixate on a price target—I simply focus on the trend and let the price evolve on its own.

On this site, I’ve previously detailed the bullish thesis for uranium. What I haven’t spoken about is how strong the incremental data-points have been since then. When I first bought uranium in September of 2021, I saw a supply and demand imbalance, along with a mechanism to sequester uranium, furthering that imbalance. Since then, nearly every datapoint was unexpected and positive. Some of those datapoints were extreme in terms of how positive they were. Oddly, I think that investors have simply missed the magnitude of what’s happening here. As a result, I’m going to spell it out as best as I can.

To start with, global energy prices spiked after the Russian invasion of Ukraine. This had surprising repercussions for the nuclear energy space. Despite a lot of anguish, nuclear is the only viable non-carbon energy technology that can be deployed at scale for baseload purposes. Prior low energy prices had allowed political ideology to overtake physics, as it’s easy to be self-righteous when power is cheap. However, faced with escalating electricity prices, including the prospect of blackouts, politicians did what they do best—they pivoted and changed the narrative.

Nowhere is this shift more extreme than in Europe, which had led the charge in terms of closing plants and villainizing nuclear energy. If you’re going to have a suicide cult where carbon is the devil, you still need electricity to deliver the daily sermon. It seems that even Davos has come to this conclusion, and their favorite hobbit is now pivoting in favor of nuclear power (at least when compared to coal).

Clearly, whoever is in charge of her talking points has been ordered to shift the narrative on nuclear. After scaring the peasants for decades, the feudal masters in Europe are undertaking a pivot of epic proportions. If you aren’t paying attention, you’re missing the whole narrative here. They need to whitewash the failure of green energy and nuclear is their only viable solution—especially as so much of the infrastructure is already built.

If you need further proof, just consider that Oliver Stone was asked to screen his new pro-nuclear documentary at Davos.

The aggressive pivot to nuclear isn’t just in Europe. China and India are also powering ahead with their reactor buildout. Dozens of plants from California to Illinois have been saved, while countries like France are postponing retirements and speaking about building new reactors. Meanwhile, Japan is in the process of turning theirs back on, while Korea has also done an about-face. Everywhere, we see plants either remaining online, or turning back on. All of this change on the demand-side is stunning, but it’s only part of the story. The bigger story is the switch from underfeeding to overfeeding.

I’m going to explain this concept like we’re all in kindergarten as there’s no sense in complicating things. Let’s say that a juice factory contracts with farmers to produce 1000 gallons of juice from each truckload of oranges, but in reality, the factory is very efficient and can actually produce 1200 gallons with that truckload. As a result, the factory sells the extra 200 gallons for a pure profit. This is underfeeding, the same number of oranges go in, but more juice comes out than is expected, causing a glut of juice and reduced demand for oranges. Now, let’s say the factory has an issue and it is no longer very efficient. The farmers are still owed their 1000 gallons, but the factory now only produces 600 gallons per truckload. Suddenly, the factory needs to scramble to find juice from somewhere else because they have an obligation to the farmers for 1000 gallons. As a result, the factory buys additional oranges and juices them, leading to a shortage of oranges and higher prices for oranges. This is overfeeding.

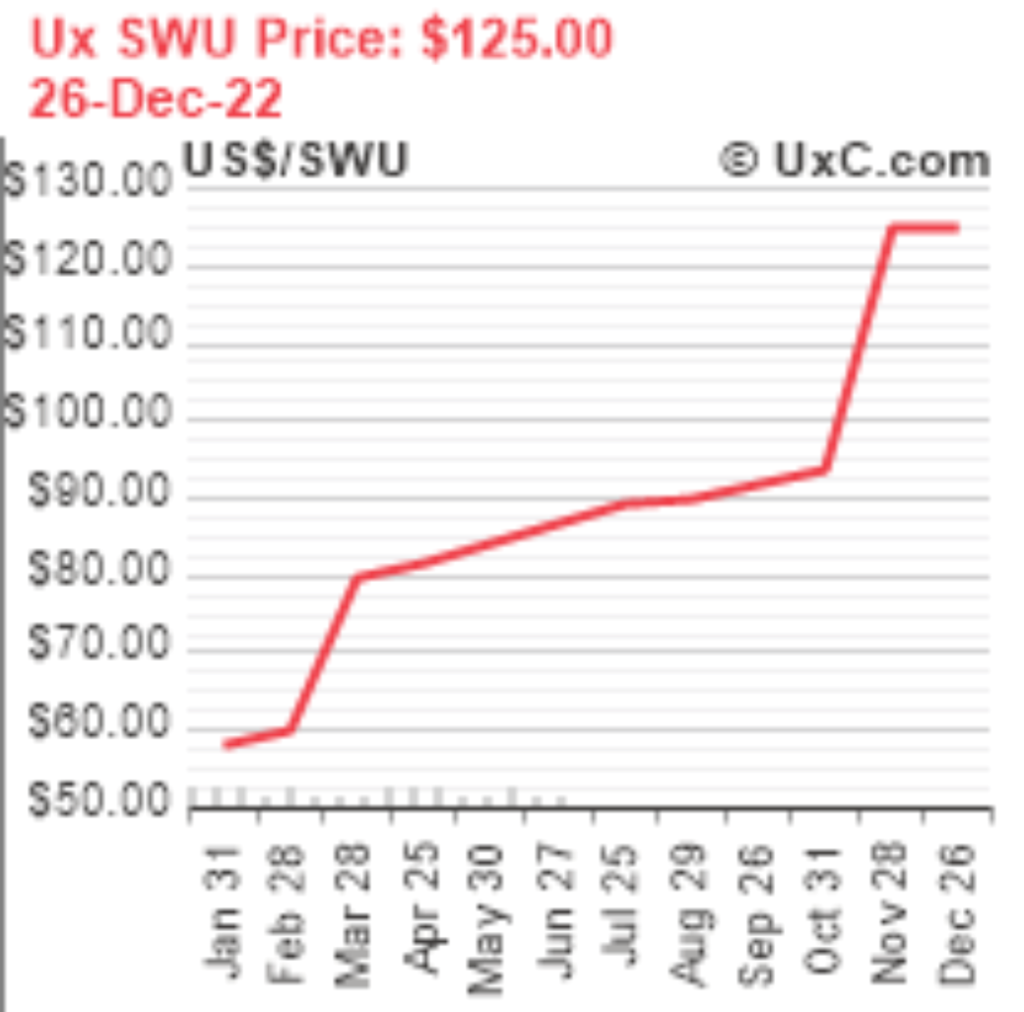

Now let’s use this analogy when it comes to enriching uranium. The cost to enrich uranium is quoted in separative work units or SWU. When SWU goes up (like it is currently), it makes sense for the enrichers to extract fewer 235 isotopes from the natural uranium and instead utilize more uranium. Not only are the enrichers no longer able to pocket approximately 20 million pounds annually for free, but they are now telling their customers that they need to procure far more uranium for the enrichment process. Estimates of the swing in total uranium demand are all over the place, but they tend to cluster in the range of 20 to 50 million pounds a year, with the bite getting staged in over the next year or two. Just watch the chart of SWU to know how many more oranges (ehhh, uranium) are going to be needed by the market. Remember, this is a market with 185 million pounds of organic demand and that demand is growing rapidly. A 20 to 50 million swing is going to break this market—especially as it is rumored that some of the enrichers sold their production in the forward market, and are effectively short uranium.

Now, let’s talk about SPUT (U-U – Canada). Originally, this one entity cornering the market was my thesis. I reiterated it a second time as it seemed to mirror the setup in Grayscale Bitcoin Trust (GBTC – USA). In any case, SPUT has now purchased 41.2 million pounds since Sprott took control. Over time, I expect that SPUT will purchase millions of additional pounds. However, while SPUT will help to corner the market, it won’t be the only driving force—the swing from underfeeding to overfeeding is suddenly at least as important, and potentially far more important. Amazingly, no one is really talking about this fact.

I understand why it’s not spoken about much. The swing from underfeeding to overfeeding is technical and difficult for many to wrap their heads around. The enrichment industry is insular and few outside of it seem to be paying attention. However, the size of the swing is going to get people’s attention when the price of uranium begins to respond. Then, SPUT likely kicks in and accelerates it.

That’s one bullish looking chart…

Over the past few quarters, I haven’t said much about uranium. This is simply a function of other things taking my attention. However, it’s a new year and everything is lining up for uranium. Macro funds need a trend to latch onto in 2023 and I don’t think there’s a better one out there—especially when funds need a trend that is both idiosyncratic and immune to all the headwinds that are impacting most other risk assets. Uranium doesn’t care about recessions or interest rates or whatever it is that JPOW is doing. Uranium only cares about supply and demand, and those two are increasingly diverging further apart.

For the first time in many months, SPUT is trading back inline with NAV and even occasionally issuing new shares in order to sequester uranium. We’ve now churned through the hot money that came into this sector when Sprott first took control of SPUT. I think we’re ready for the next round of fireworks soon.

In conclusion, I cannot think of a trend where the macro has exceeded my expectations by this magnitude in a very long time. Sure, there was more physical to absorb than I may have expected, but a year of deficits does wonders in that regard—as does over 40 million lbs of SPUT buying. There will come a day when the price moves higher, and then this becomes the most reflexive trade on the screen.

I think that 2023 is the year that this all matters.

The Pause…