I believe the vast majority of publicly traded securities are roughly fairly valued. Sure, there may be a 30% or even 50% variance to fair value, but that’s mostly encapsulated in annual volatility. Unless I’m looking at something with an Event-Driven mindset, where my capital turns over rapidly, I’m mostly uninterested in such meagre expected returns. Honestly, there are better things to do with my capital. I crave asymmetry.

Unfortunately, what’s often peddled as asymmetry is simply risk that has been re-packaged. I’ve been at this game for a long time and have the battle scars to prove it. I want true asymmetry, not idiosyncratic risk. I don’t want to get into something that requires a herculean level of execution, as those almost never work out as expected. I can cry you a river of failed mining or VC deals where I got diluted to bits. Bio-techs may have asymmetric upside, but even the experts often get those wrong—what chance do I have? Want to bet on geopolitics? Local politics? What about guessing what a judge will rule in a court case? There are dozens of these opportunities. Some work, some don’t. Often, they tie up capital for longer than expected and then turn out badly. There may be multi-bagger upside, but it is a very risky kind of upside. The truth is that most of these situations are probably priced correctly, maybe even generously when you realize how long it will take to play out—especially when compared with the realized returns. These aren’t asymmetric—they’re simply risky.

But I crave asymmetry. Where do I find it? I often find it in those rare situations where a sector has been forgotten and left for dead—where any spark of life will lead to a multi-bagger. More importantly, I look for situations with minimal risk. Losses are the bane of all investors, especially super-concentrated investors like me. I really don’t have the flexibility to get one disastrously wrong. I hate situations where I can lose badly, especially as I don’t believe in taking small positions.

When a situation comes around, one with what I perceive as a defined risk and exponential upside—I max it out. For the right situation, I get positively piggish about it. There are so few great opportunities, so few times where the risk is negligible, yet the upside is exponential, that when I find one, I push my chips across the table. Over time, I believe what separates the real winners in this game, from the benchmark huggers, is the ability to really max out those special opportunities that come around occasionally. It comes down to knowing your craft, knowing your history and being realistic about when a setup is special. Sometimes, it just makes sense to be a pig and gorge on exposure.

I bring this all up because I think the time has come for uranium. I have already detailed my thesis. However, over the past few weeks, my bullishness has hit Level 11.

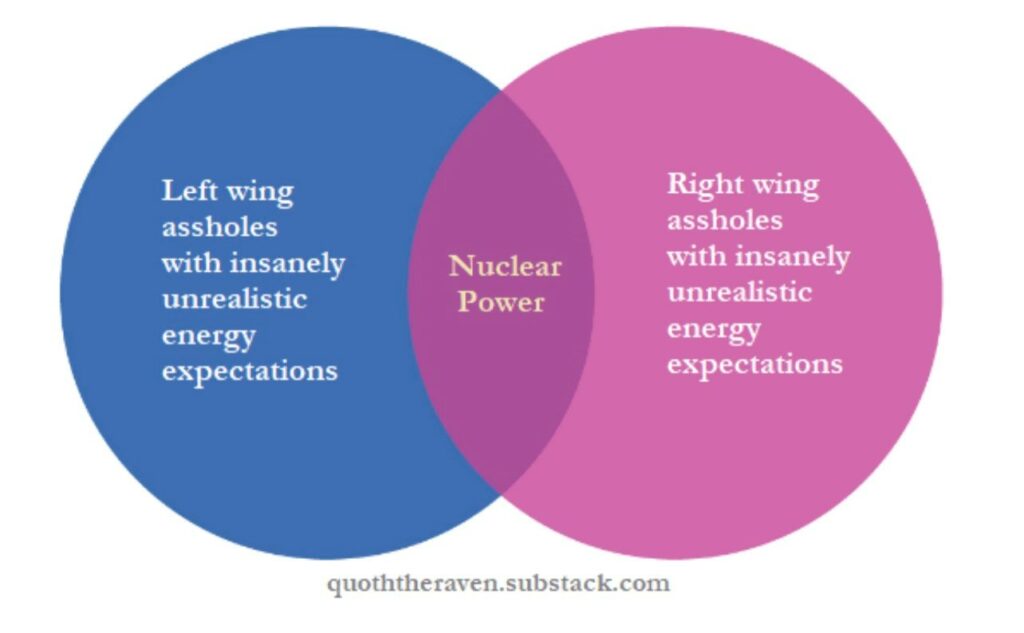

I believe what turns a great setup into something incredible, is when the facts accelerate dramatically to the upside and the price barely moves. Since I first wrote about uranium, we’ve seen; the new Japanese Prime Minister come out in favor of restarting their mothballed reactors, France postponing deactivations and planning for new reactors, the UK realizing that nuclear is the future, the various Green Parties of Europe determining that nuclear is now “green,” and even Illinois deciding to postpone two retirements. The biggest incremental data-point was last week when China decided to build 150 additional reactors. Future uranium demand looks to be going parabolic. Meanwhile, supply hasn’t responded in any meaningful way. If anything, Sprott Physical Uranium Trust (U-U – Canada) has continued to sequester pounds, reducing future supply.

This has all the makings of something explosive. Into the brief pullback last week, I grabbed a bunch more exposure. The facts kept getting better, yet the price is only marginally higher than where I bought my first tranche. Why wouldn’t I press this bet? Besides, I see the low $30’s on physical as my downside risk—as uranium was trading there when nothing was going right for it. I always try to set these inflection trades up the same way; max out at the inflection, before the price moves much and ensure that I’m only risking a few to make something silly if it plays out. This one seems like a textbook setup.

The world appears to be rapidly pivoting towards nuclear. Almost every day, we hear of another country panicking to embrace it—which is what occurs when other fuel options surge in price, while your voters have been brainwashed against carbon. Meanwhile, this is all happening at a time when supply is constricted. Where will all the uranium come from to fulfill the demand? Honestly, I have no clue. I just feel it will happen at a higher clearing price. Meanwhile, Sprott continues chomping away at the above-ground stockpile.

I own a whole lot of Sprott—a true position maximum. I’ve supplemented it with Kazatomprom (KAP – LI) as the dominant and low-cost global producer really ought to attract serious investor attention if this plays out like I think it will. I’ve then rounded out the basket with a smattering of other tickers—mostly speculative stock-promotes, meant to be peeled-off along the way, so I won’t bother to mention them.

Returning to my point above; I believe there are so few truly asymmetric opportunities in this market. When you’re pretty sure that you’ve got it right, when the facts keep getting better, when you can quantify your risk, if you aren’t maxing it out, what’s the point of even playing this game. Winners know to push it when they have the nut hand. Most investors are so fixated on diversification and reducing volatility, that they forget that sometimes there are trades that you should truly be piggish about. Risking what I believe is $10 on physical uranium to potentially make a multi-bagger, sure seems like one of those trades for me.

I believe that it’s the winners that make a performance record. Multi-baggers drown out the mistakes. Maxed-out multi-baggers make a career. Every indication that I come across is that uranium is going mainstream. It actually reminds me of buying Bitcoin last year. We all know how that worked out…

Will ESG Create The Next Lehman Moment…???