On Playing Gold…

Last year, I wrote Part 1 of The Great Macro Dreamscape (Part 2 is coming). To summarize, my view is that the coming decade will be the best of times if you can trade and profit from Global Macro, or the worst of times if you’re a peasant trying to survive the Global Macro. Since […]

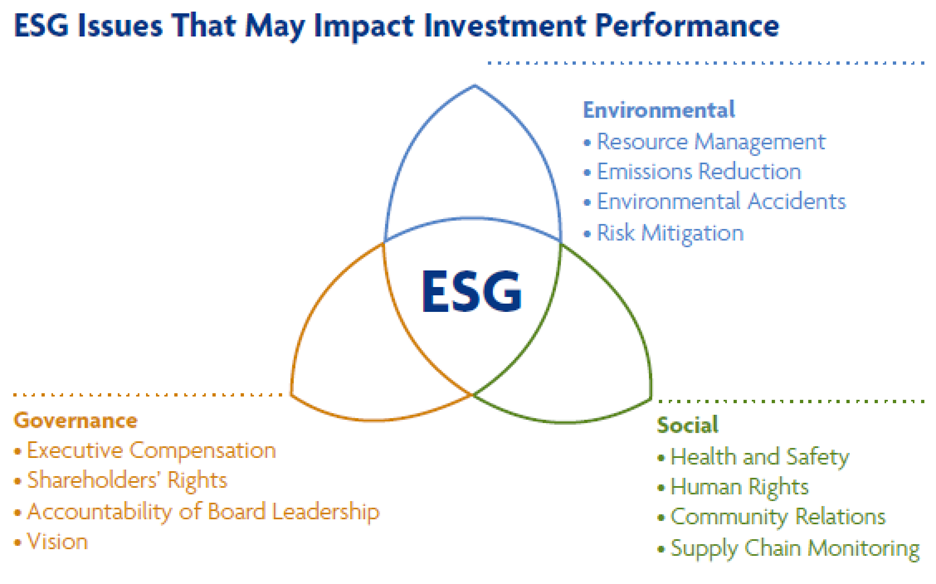

ESG = Excessive Share-price Growth

Two months ago, something rather monumental happened, which seems to have been lost to the news-cycle. In a world starved for yield, a company with trailing twelve-month free cash flow of $527 million (cash flow from operations – maintenance cap-ex) and net debt of only $593 million could not re-finance debt due in 2022. Sure, […]