I’m an absolute return investor. I recognize that benchmarks exist, but I also largely ignore them, as I don’t expect my returns to be particularly correlated with any of them. It’s nice to know how others are doing, but it’s also irrelevant to my own investing process. However, every so often, benchmarks matter, and then they tend to matter a lot.

Let’s face it, large pools of capital are effectively tied to benchmarks. They’re told what the bogey is, and they’re expected to try and beat it, with the understanding that they will probably lag by a bit. That’s simply how the institutional investing game works. You can overweight your favorites, and underweight the dogs, but you’re likely targeting an exposure that’s within a thousand basis points of your benchmark, as you risk getting fired if you lag too badly.

I also recognize that big pools of capital (Sovereign Wealth Funds, Central Banks, Pensions, Endowments, etc.) are often benchmarked against global indexes, as they frequently serve masters outside of the US. Despite their global benchmarks, over the past decade, the smart Portfolio Managers (PMs) realized that if they overweighted the US, particularly large cap US tech, they dramatically outperformed their global benchmarks. There is nothing quite like big bonuses to incentivize a PM to continue doing what’s working—which meant shifting a few hundred additional basis points each year into US assets. Over time, through a combination of continual reallocation, US outperformance, and a bit of currency appreciation, these portfolios became dramatically overweight the US.

Then, Trump happened…

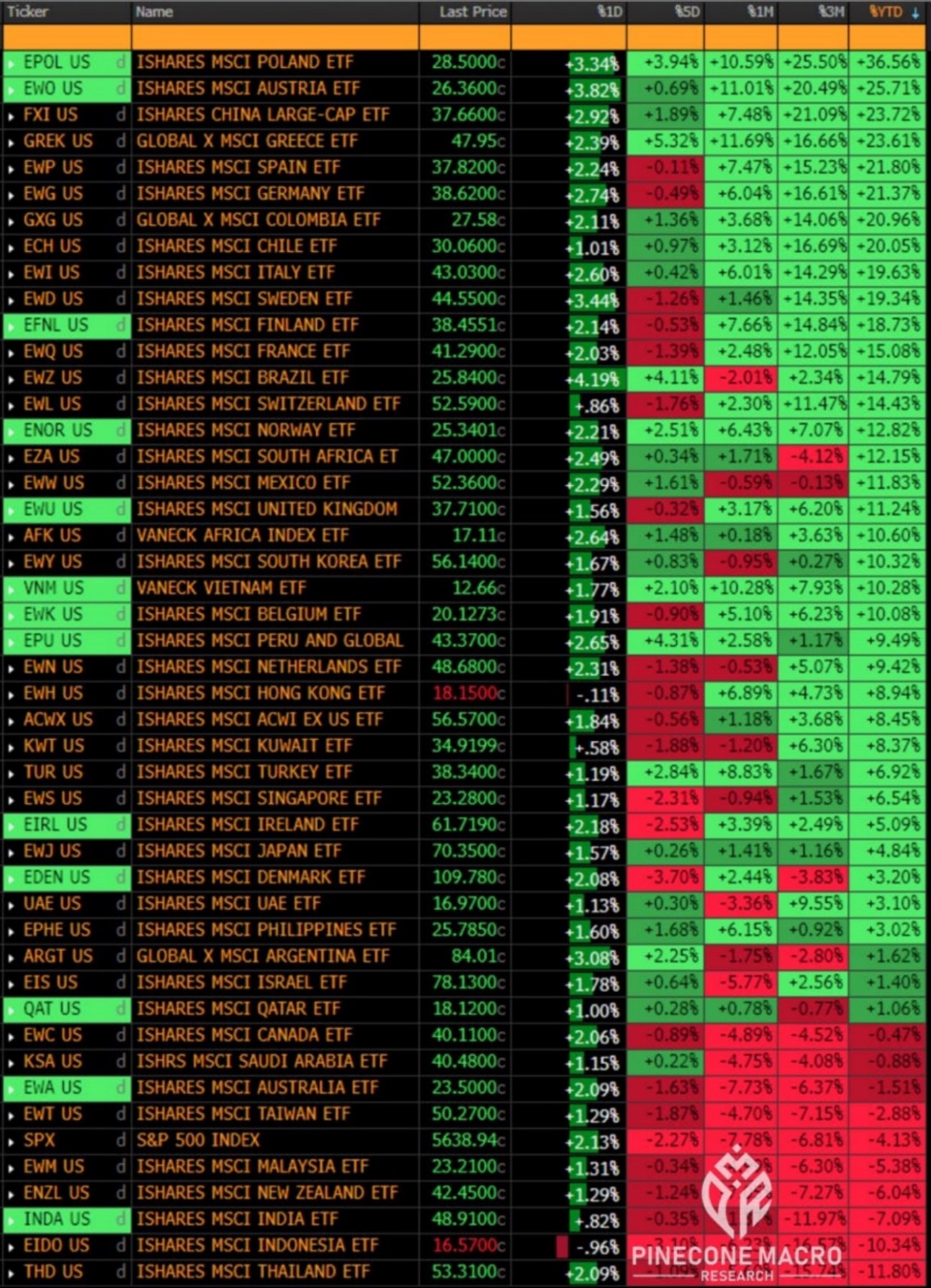

Suddenly, foreigners started selling US stocks out of spite, at a time when US equities felt like they were topping out anyway. Foreigners have then been repatriating the proceeds and buying their own domestic stocks. There are now 40 country ETFs that are ahead of the US, with many of these markets up double digits. (Chart shamelessly lifted from Pinecone Macro’s new Pinecone Passport—you should all subscribe).

Remember how big pools of capital are measured against global benchmarks, but over the past decade, everyone who chose to be overweight US assets, dramatically outperformed?? This led to inflows, big bonuses for everyone on the investment committee, and lots of incentive to buy even more US assets.

Well, the last 75 days have exposed a lot of portfolio managers who are now dramatically offsides. Imagine a hypothetical example where you’re a European pension fund, and you’re suddenly trailing your benchmark by over 10%. Part of it is the dramatic decline of all the US equities that have been overvalued for years, yet continued to get more overvalued. Part of it is the dramatic snap-back in European, Chinese, and Emerging Market equities that have largely gone nowhere for over a decade, despite retaining earnings and creating a lot of value. Part of it is the big rally in the Euro. After a decade of overweighting US assets against domestic ones, suddenly, it feels like the world has flipped on its head, all because of some Tweets.

In my world, when I have a bad quarter, I re-underwrite every position and think through what I could be missing. In the benchmarked world, you don’t have that luxury. You’re simply not allowed to trail by 10%. It’s existential. It’s a career ender. Every day, you sit there, just praying that US tech bounces, while international markets decline. All you want to do is re-allocate back to your benchmark with a bit less pain. Except, there are thousands of other PMs all doing the same thing, and they have hundreds of billions or even trillions to reallocate, hence you never really get the pullback you want. Instead, you’re forced to go for it, reallocating a bit each day, every day, for months—knowing that your own allocation decision is pressuring US tech, while mooning everything else in your surprisingly illiquid benchmark.

Last January, I wrote about my friend who was underweight NVIDIA and how it was killing him. In the benchmarked world, you’re not allowed to not own the thing going up—you’re not allowed to underperform. That’s why big trends in motion tend to stay in motion—not because they make fundamental sense, but because big pools of capital have to keep reallocating—especially when they start the process this far offsides in terms of their global benchmarks.

Every day, I look at overseas markets ripping higher, as US tech leaks lower. Then I see commentators trying to make sense of it from an economic standpoint, but it’s not going to make sense until much later. For now, it’s all about fund flows, and PMs scrambling to get back to benchmark. I think this trend continues, and it continues for a while, especially as politicians demand that capital is reinvested back at home. It won’t be a straight line, and there will be a lot of volatility, but until PMs get back to benchmark, this is the direction of travel, and foreign markets are too illiquid to handle the flows. However, that won’t stop these PMs from trying. As my NVIDIA buddy taught me, never underestimate the pain of a benchmark bro, who’s desperately trying to catch his benchmark. In any case, I’m quite overweight overseas assets, having ramped up my exposure aggressively, right after Trump got elected. I think the trend will continue, and the starting point in many of these markets is quite cheap from a valuation standpoint.

On one hand, it’s simply a question of fund flows. On the other hand, there’s a certain reflexivity to fund flows reducing the cost of equity capital in markets that have been starved of capital. There’s a reflexivity to the US Dollar weakening from these fund flows, while Emerging Markets thrive on a weaker Dollar. There’s a reflexivity to an increase in domestic credit as capital returns home. The world has suffered through a US asset bubble of historic proportions. As that bubble deflates, there will be second order effects in the US—many of them quite negative, in terms of unwinding the wealth effect; along with second order effects overseas—many of them quite positive. It’s certainly possible that fund flows will ultimately lead to overseas economic growth, justifying continued fund flows—a virtuous cycle if you will.

The overvaluation of US assets was bound to eventually mean-revert, especially as the fundamentals were horribly unbalanced. Once started, I think this can continue for many years.

Remember how I warned that MAGA, which fixes the long-term fundamentals of the US, is not bullish short-term US equity prices?? Well, it’s happening…

The Problem With Ponzis…