I started following financial markets during the Asian Financial Crisis. I remember the Fed stepping in as LTCM detonated, and I instantly understood the moral hazard of saving financial institutions from their own stupidity. I watched as the Fed panicked over the Y2K non-crisis, only to blow the internet bubble to stratospheric heights. Since then, I’ve watched the Fed rush into every crisis, real and imagined, with unlimited liquidity, and reduced interest rates. I even watched the Europeans trial negative interest rates. Four years later, we’re still trying to reduce the excess Covid liquidity that the world’s Central Bankers sprayed at literally anyone and everyone who’d oblige by taking it. To a man with a hammer, everything looks like a nail. To a Central Banker, the solution is always more liquidity. To an investor, the lesson has been to hold on for dear life, outlast the crisis, then lever up, because the subsequent liquidity-induced rally will be life-changing.

For the first time in almost three decades, I wonder if the rules have changed. What if the Fed is no longer there to protect investors?? What if the Fed will now be forced to penalize investors during the next crisis?? What if the investing universe is so pre-conditioned that they can’t appreciate the rules changing??

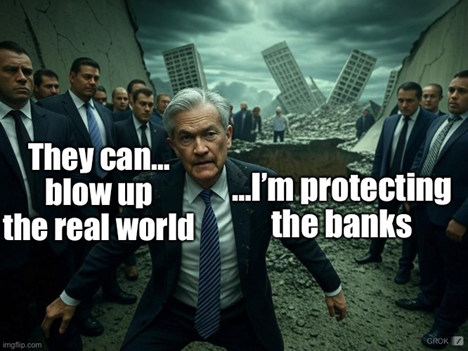

As I watch the bond market perpetually leak lower, I wonder if the prophecy of Developed Markets (DMs) becoming Emerging Markets (EMs) is coming true. If so, the accepted relationships become inverted. What if during the next crisis, the Fed is forced to sop-up liquidity, and rescue the bond market?? What if they must raise rates aggressively, to show the bond market that they’re serious about inflation risks?? While the Fed is loyal to equity holders, its primary mandate is to protect the banking system from a cascading failure. Remember the various alphabet-soups of programs that have nursed failing banks to health over time??

In early 2023, various US banks got put to the wall. A few even failed. At the time, 10-year bonds were kissing up on 4%. Not surprisingly, banks started choking on duration. Today, 10-year bonds are making a move on 5%. If 4% was a kill-shot for some fragile banks, you’d have to think that 5%, and beyond, becomes existential—even for some of the more robust banks. 10-year US Treasuries are the bedrock financial asset for the global financial system, the prime collateral in the ecosystem—as they decline in value, a global margin call takes place. Banks, as highly levered entities, will be the ones to experience it first.

Ever since I started following markets during the Asian Financial Crisis, I knew that the US was functionally insolvent. Doom prophets continually warned of it, occasionally Congress would undertake a study to prove it, then they’d kick the can. With 2-year election cycles, and insolvency, theoretically decades into the future, no one particularly cared. Besides, the issue was always an actuarial one, and the accounting for entitlements is both complex, and easy to manipulate. Now, what was an actuarial crisis, is becoming a cashflow crisis, as boomers are starting to retire. They’ve stopped paying into the entitlement system, and they want their money back. Actuarial earnings are an opinion, cashflow is real—you can’t fake it. Our government deficits are becoming structural, made far worse if the capital gains windfall ever abates, further accelerated by increasing funding costs. Does anyone actually believe that the inflation rate is somewhere in the 3’s?? Seriously, who’d buy our bonds at current deeply negative real rates?? The bid under bonds is disappearing, for good reason.

The rule of Ponzi Schemes is that they inflate if more capital goes in than comes out—they deflate if more capital comes out than goes in, and they’re highly unstable. Using that set of rules, our financial Ponzi Scheme is now seriously imperiled, and the leaking 10-year is the cope mechanism as investors realize that the joke is on them. Ponzi Schemes are a trust-based system, and the trust is clearly eroding. Bondholders have never expected the US to run balanced budgets, but they also didn’t expect to get abused with 7% deficits in a boom economy—implying double digit deficits during the next recession.

In my last post, I noted that I expected them to “Run It Hot.” The corollary is that this likely implies even larger deficits, permanently elevated inflation rates, and much higher interest rates. It implies that bonds potentially become a wrecking ball within the over-levered financial system, especially as the real economy takes longer to really gear up and carry the burden of deflating the nominal debts of the world. To manage this transition, takes grace and dexterity from policymakers. We need to handle a two-speed economy where the real economy heats up (inflationary) while the over-levered financial economy is somehow defused. I have never seen a government achieve both goals simultaneously, and we all know that Trump doesn’t do ‘finesse’ in complex situations.

Instead, I expect to see a see-saw effect as bonds blow-out, topple a few financial institutions, leading the Fed to panic. They’ll try some alphabet soup of programs to prop up the long end, but it will only entail injecting more liquidity. Therefore, we’ll “Run It Even HOTTER,” leading bonds to leak more, blowing up even more financial entities. Unlike during the GFC, the only cure will be to remove liquidity and save bonds, which will destroy the stock market. Of course, policymakers will never try that, but they’ll threaten it and create sudden and severe panics.

I think we’ll vacillate between waves of financial institutions detonating on increased rates, offset by faster nominal GDP growth that soothes investors. Ultimately, we’ll see banks try and outrun their duration problems, by dramatically increasing their balance sheets—through shorter-term, floating-rate lending. Loan growth in the US has been slow for a while, I think it ultimately heats up as banks scramble to offset duration with a higher average portfolio yield—as usually happens in Emerging Markets that transition to a higher interest rate environment. What do you think that does to nominal GDP, or the inflation rate?? What do you think bondholders do?? Will they puke bonds, spinning the cycle ever faster??

I increasingly suspect that the next move is a bond blow-out, at a time when the US economy is obviously stalling out. Slowing growth is usually bullish for DM bonds, but incredibly bearish EM ones. Which will it be in the US?? Simultaneously, I see a solvency crisis brewing in many sectors of the financial system, as many asset values are grossly mismarked, particularly in Private Equity, Venture Capital and Commercial Real Estate. You can extend and pretend in a stable rate environment, but in a system where funding costs are permanently grinding higher, eventually those costs cause outside actors to act. You cannot ignore marks indefinitely. Raising the veil on valuations will be a complex and volatile process—many that we hold in high regard today, will be bankrupted in the process.

Look at the corporate bond market. Think about what happens to interest coverage ratios as corporations hit the refinancing wall and are forced to roll debt at much higher rates. Look at pro-forma interest coverage ratios. Think about what happens as capital available for buybacks evaporates, and companies instead need to raise equity capital to de-lever. Yet, the Fed won’t be there to protect investors—the Fed will be trying to solve the rolling banking crisis caused by rates, duration and collateral going bad. Except, they can’t just flood the market with liquidity, as that accentuates the problem on the long end. Instead, they’ll be forced into hawkish soundbites to salve bond investors.

As you travel the world of EM investing, you’ll note that high-quality Brazilian companies trade at mid-single digit earnings multiples, and many of them have double digit dividend yields. Lula wants to “Run It Hot.” At least, there are positive real yields in Brazil. Now, traipse through the capital markets of Turkey, where Erdogan is “Running It Even HOTTER.” In Turkey, super high-quality businesses trade for low single-digit earnings multiples. This is what happens in EMs with high funding costs. Imagine if that becomes the template for US valuations? It’s already happened once in the 1970s, as interest rates increased. It can certainly happen again. Except now, the structural problems are far worse.

What if, for the first time in my investing career, the rules are inverted. What if the Fed isn’t there to protect me?? What if the Fed needs to abandon the equity markets to their fate?? What if the Fed is forced to save the banking system and the equity markets become collateral damage?? No one alive is prepared for this, except EM investors who have seen this scenario play out every few years for their entire lifetimes. Go and research the markets of Brazil and Turkey. Look at what happened to equity multiples. Look at what the Central Banks did to regain control of the situation. Look at how bank lending responded. My buddy, PauloMacro, keeps telling me “We’re speaking Portuguese, and we don’t know it yet.” I think that we all need to internalize and accept this fact.

Since pretty much the lows of the Covid Crash in March 2020, I’ve been a raging bull on most CUSIPS. I called the top in Ponzi in 2021, but stayed long the real economy. In the summer of 2022, I called bullsh*t on a pending recession. In fact, I doubled down on real-economy cyclicals like housing. I rode this cycle for as far as felt prudent. During the spring and summer of this year, I undertook a culling of less liquid portfolio positions. I’ve grown timid over keeping long-sided exposure, and I’ve run a thinner book ever since. I missed the resurgence of Ponzi in 2024, but have zero regrets. I think this is the final blow-off in American Exceptionalism as an asset class—I worry that the back-side of the peak will be unusually steep. I have this sinking feeling, that with a bunch of structured derivative products resetting in January, right as Trump unleashes MAGA, high-multiple US assets will get a gut-punch. Bonds already cannot hold it together, and we all know that Trump wants to “Run It EVEN HOTTER.” I think it only gets worse for bonds—the global margin call is accelerating on financial assets, right as real-economy assets are awakened by Trump. This is a combustible combination.

I’ve been adamant that you don’t short “Project Zimbabwe.” For the first time in ages, I have built up a pretty substantial book of longer-dated put spreads on various indexes. I’ve even tempted fate on the short side (with VERY tight stops). Real economy names may do alright—if only because they’re so under-owned, but most equity investors are crowded in overvalued tech, and fantasy themes of dubious quality. The Everything Bubble suddenly feels highly unstable. I think 2025 will be a year that most equity investors will want to forget…

The Pause…