Emerging Market governments are highly attuned to changes in their bond markets. This is because they risk getting cut off from funding at any sign of stress. Often-times, Emerging Market leaders will do crazy things that appear inexplicable to outside observers. At such a moment, the bond market comes to the forefront, because if bonds rebel, it becomes incredibly difficult to reassert control of the situation later-on, especially as funding costs explode, driving deficits higher in a feedback doom loop. In many ways, this is the curse of an Emerging Market that doesn’t act with fiscal prudence. We’ve seen this most recently in Brazil, where the Central Bank has been forced to raise rates each time Lula got out of line. The risk of a bond rout was too great if they didn’t. The thinking was that it was necessary to stop the long end of the curve from blowing out, even if short term economic pain had to be doled out through higher short-term funding costs.

I bring this up, because Scott Bessent has been on a never-ending roadshow for his bonds. I like to joke that he’s gone on podcasts that I wouldn’t even consider appearing on. He’s been pumping his bonds to anyone and everyone; yet has very little to show for it. I’m going to use TLT, just because it’s a liquid mark on the curve that we all grudgingly track. Since Trump was sworn in, TLT is up roughly $2. Maybe in an Emerging Market, with an aggressive investor outreach program, one would call that a success. In the US, where the treasury could always bully the bond market when needed, this is rather pathetic, especially given the fact that equity markets were in free-fall, usually scaring investors into bonds.

My good friend, Le Shrub, has perfectly described Bessent’s bond pitch…

In prior postings, I’ve written about how Developed Markets are becoming Emerging Markets. I’ve postulated about the moment when the government would finally lose control of things. I’ve also wondered for how long investors would lend long-term money to our government with a 4-handle, when fiscal deficits are clocking in at a 7-handle, especially while nominal growth is slowing. It all seems so illogical and obviously unstable, but so much of our financial matrix is simply the composite of historical fund flows. Therefore, a direction change needed a special moment to awaken bond investors to their impending doom.

Has Liberation Day served to accelerate the reallocation?? Have we finally reached the moment where US bonds become the only asset that matters to finance, as US bonds are the core collateral asset in the global financial system?? Will the Fed soon be forced to rapidly raise interest rates to defend the bond market, and with it, the global financial system?? What are the consequences of the Fed abandoning equities to their fate?? What about the effects on funding costs for all the highly financialized assets in our economic system?? How high will short-term rates have to go, before they stabilize bonds, if bonds really start selling off??

These are the sorts of questions that I ask myself, after a historic 4-day equity rout, that sees the TLT trading down since Liberation Day. I’m old enough to remember bonds gapping away during the GFC and Covid market crashes. Yet, this Liberation Day crash feels oddly different in the bond market.

Now, one short trading window does not make a market. However, as a market participant, I’m highly attuned to clues on the path of things. For the past few years, I’ve been correct to not only be bearish bonds, but to genuinely wonder what happens when they eventually go into freefall. I don’t think anyone has a good answer to this, as the world’s primary collateral asset has never set off a global margin call. Think of SVB, but applied to the larger banks. Of course this is all theoretical, but if you borrow at 2.5% on a 3-cap property, what happens when you must refinance at 7% and the property is a 9-cap?? Now multiply that by trillions in loans.

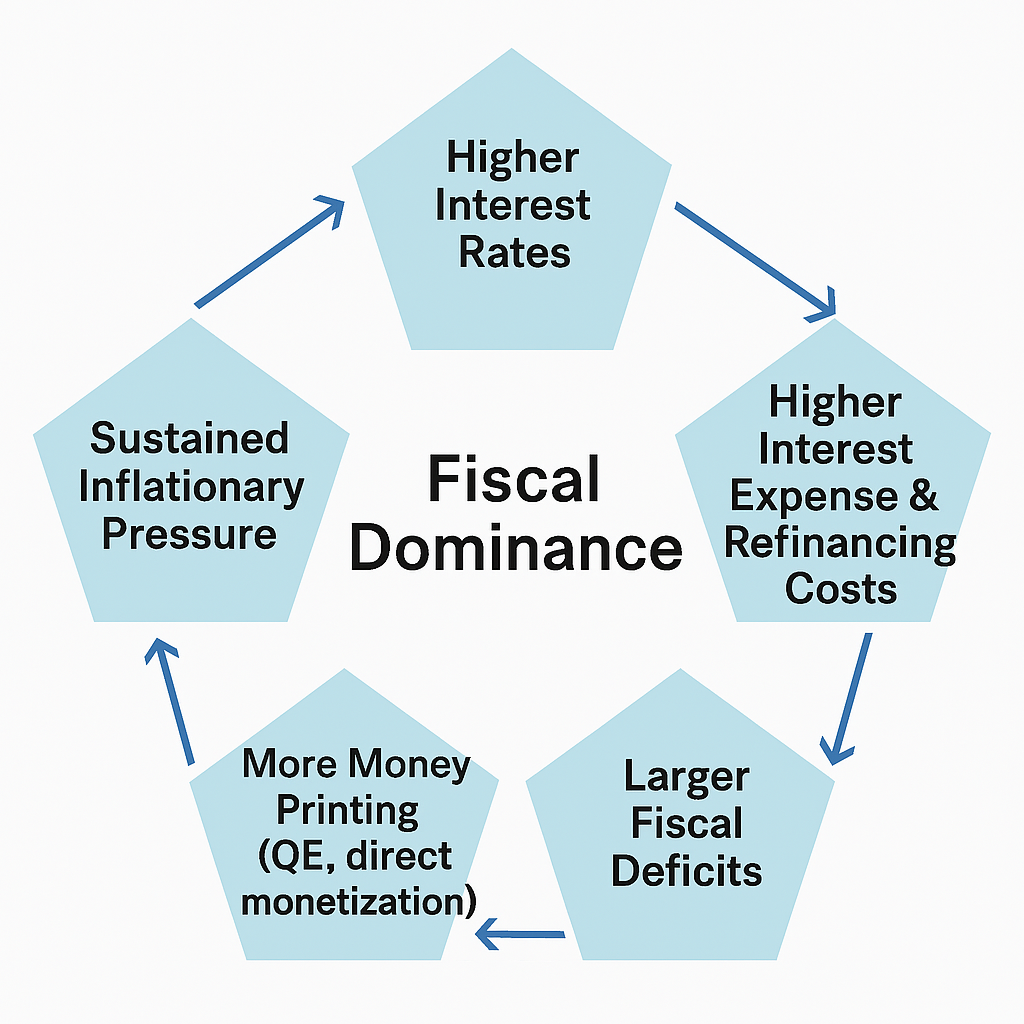

Those who invest in Emerging Markets are familiar with the concept of Fiscal Dominance. Developed Market investors will soon learn this term as well. This is when the Central Bank loses control of it’s core mandate to tinker with inflation and employment. Instead, the Central Bank is forced to focus on the government’s fiscal needs—either through monetizing debt or stabilizing the bond market. This then starts a vicious feedback loop that is difficult to escape from. At some point, investors wake up and decide they’re not going to throw good money after bad.

Applying this thought progression to equities. When I look at equity valuations in Brazil, and then look at valuations here in America, I realize that the gap between the two is quite wide. In a higher interest rate regime, equities are often priced at single digit earnings multiples, as opposed to the crazy multiples that we’ve taken for granted in America. Now, I’m not calling for a crash. It took Brazil over a decade to deflate to where it is today. Then again, Brazil didn’t have anywhere near the level of financialization that we do—nor did it rely as highly on foreign flows to finance itself.

Part of me says that lower equity values are simply an inevitable reset. A lower US Dollar will benefit many domestic businesses, and higher yields will impute a return on capital function into investment decisions that have recently experienced epic capital misallocations. One could say that all of these things are good and desirable. I’m not opposed to tariffs. I believe strongly that many of our trading partners have been taking advantage of us. Finally, this piece is not a critique of Trump, though it may read like one. Our bond market didn’t get where it is today, without multiple terrible decisions over many decades. However, sometimes in markets, the most innocuous event, can set off an avalanche. I wonder if this trade war just made a lot of investors ask themselves why they’re lending money to a country acting like an EM, but at DM rates. If bonds start to slide, do more investors ask themselves the same question??

Maybe this is all benign, a persistent bond bear is prone to see things in his own lens. However, I’m terrified that bonds are acting like the next leg down is starting soon…

When The Levee Breaks…