OPEC’s Counterattack…

The Federal Reserve has been attacking inflation. The problem is that after printing trillions of dollars, they’re ill-equipped to succeed at their task. Partly, this is because all that cash has to go somewhere and partly this is because their mandate does not extend into ensuring that global energy production expands. While Owners’ Equivalent Rent […]

The Fed Is Fuct Part 3

Investors like to focus on QE and QT, because of the belief that the quantity of money has an immediate effect on risk assets. In the same way, we like to focus on the Fed Funds Rate as the price of money also has a dramatic effect on risk assets. Oddly, we rarely focus on […]

The Pause…

I have frequently described “Project Zimbabwe” as a highly inflationary cycle where both fiscal and monetary stimulus go into insanity mode. While I sincerely hope we don’t go hyperinflationary like Zimbabwe, I certainly think we see an elongated period of substantial and debilitating inflation. When this cycle finally ends, society and our financial system will […]

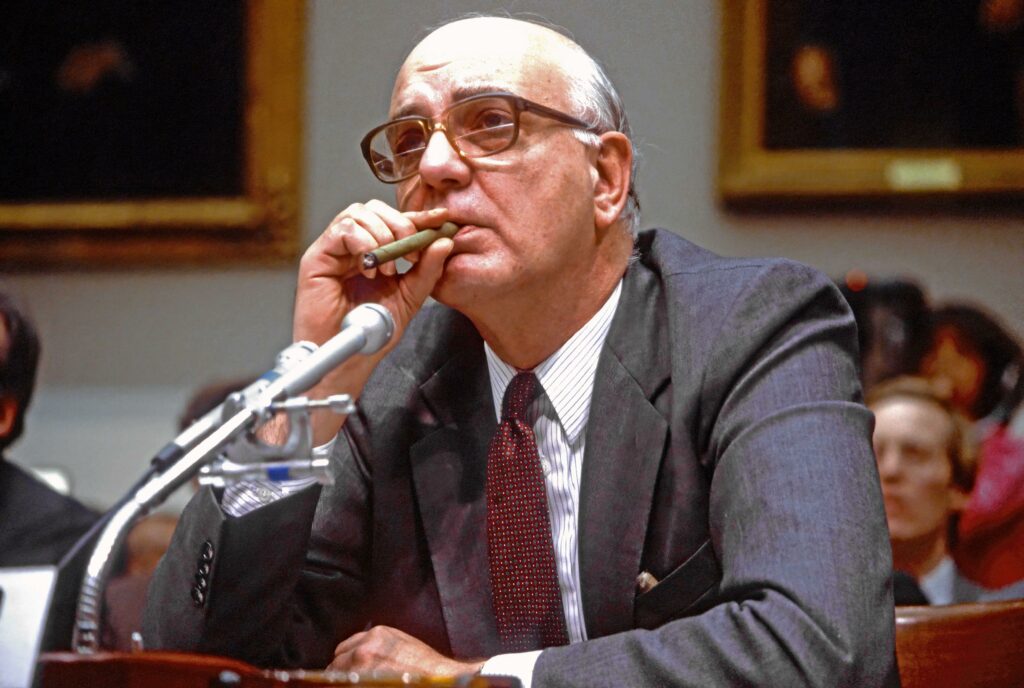

Volcker and Inflation…

For my entire career, Paul Volcker has been deified. In fact, I cannot think of an unelected government official, since the Generals of WW2, who is held in such esteem—which may also be a function of how terrible most government functionaries are. As JPOW suddenly pretends that Volcker was his boyhood hero, I think it’s […]

The Fed Is Fuct (Part 2)…

Let’s try a thought experiment here. Fast forward into winter. The Fed has been on autopilot and has continued to raise rates. They’ve managed to crush risk assets and the “negative wealth effect” is rapidly filtering through to the consumer economy. All the guys trading meme stonks and monkey JPEGs have now returned to their […]

The Fed Is Fuct…

The Fed is fuct. I think they know it. We all know it. And it’s likely they know that we know it. They intend to continue the charade anyway. Despite centuries of study, I think it’s clear no one really knows what causes inflation. While it tends to show up during periods with excessive money […]

In Defense Of Housing…

It is said that generals always fight the last war. I believe investors do the same, but with a greater sense of PTSD, combined with self-assurance. Often, investors cluster in groupthink, focused on narratives—completely ignoring facts. Nowhere does this appear more extreme than in the housing market. On one hand, you have everyone from homebuilders […]

The New Levels…

For over thirty years, excluding a few brief spikes, copper traded in a range between $0.60 and $1.00 a pound. In many ways, that range became self-fulfilling as an entire generation of producers and consumers came to expect that it would remain in that range. They’d sell excess inventory when it poked over a buck […]

Market History Often Rhymes…

I’m often reminded of how Mark Twain was rather prescient in regards to markets. Let’s reminisce a bit, back to a simpler time, when an obscure entity named Grayscale Bitcoin Trust (GBTC – USA) was hoovering up Bitcoins on a daily basis. I predicted that eventually, it would acquire enough of the “free float” that […]

The Most Annoying Risk…

People really like to complicate things. They worry about non-problems. They over-trade. They over-think. They ignore the obvious. I believe this investing game is actually quite simple—buy unusually cheap companies with strong macro-tailwinds and then don’t sell until something changes. It’s really that easy. Unfortunately, I’m not the only one practicing this craft. While the […]

Oil Is The Wrecking Ball That We All Deserve…

I’ve been pretty clear on why I think oil is going higher. I’ve also been clear that when oil overshoots, I think it’s going to create the next Lehman moment. Oil is the wrecking ball that will crush every CUSIP, because the Fed will eventually panic. Look at bonds. They’re getting smashed along with equities today. This […]

The Great Rotation…

In a few short hours, we’re headed back into the trenches. No sleep for us weary hedgies. They’ve re-set the performance clock at zero and we’ve got to fight our way forward, showing why we’re worth those incentive fees. Before heading off for battle, I figured a 2022 roadmap would be helpful. Here’s mine. I’ve […]