Humor me for a bit, as I engage in some political theory. Don’t worry, when the narrative returns, we’re going to be looking at an investible Mega-Trend that no one is following.

Put simply; governments exist to extract wealth from the productive class and channel that wealth to the political class. We all accept that this is inevitable, and since we get some services in return, we grudgingly accept this state of affairs—much as humanity has since civilization began.

Let’s go back in time. For the majority of human history, the primary source of wealth was agricultural land. Governments would tax that land, or the production from that land. Those with land were given titles and were expected to show a certain level of loyalty to the government, in return, the government often purchased goods from the landowners, returning part of the tax receipts to them. It was a somewhat circular economy, but with a lot of slippage to the government. The rest of the peasants produced little of value, and consumed little tax revenue in return. They weren’t really part of the equation, outside of some tariffs on the merchant class. The government was happy with this state of affairs, and the landowners couldn’t do much unless they all teamed up to depose the government.

When the industrial revolution began, most governments looked at factories as yet another form of immobile property to tax—not so different from a gristmill. The difference was that factories were far more productive than agricultural land, and within a few decades, the factory owners became far wealthier than the landed gentry who previously made up the tax base. Additionally, in the Great Powers competition of the 1800s, there was a nationalist desire to let factories and then railroads proliferate, hence a hesitancy to tax them. This was only accentuated by the need to constantly reinvest capital into these industries, often for the national good. Therefore, governments allowed for a depreciation shield, making factories into a poor tax base, as opposed to agricultural land with a more constant yield, and a lower level of depreciation. As a result, governments realized that they could unionize the workers, improve the wages a bit, and then tax those wages instead. Within a few decades, the tax base shifted from the millennia-old tax on fixed assets, to a tax on the working class.

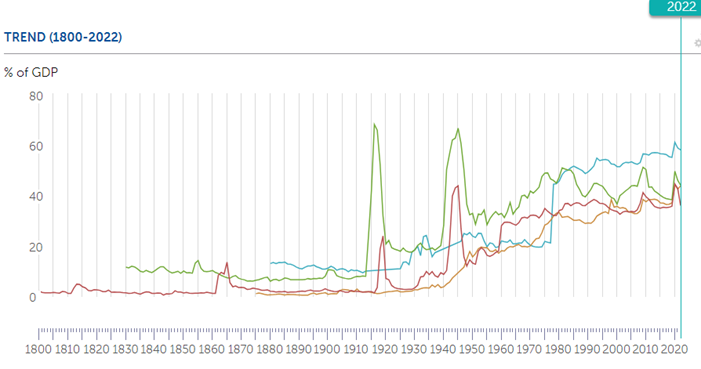

Eventually, unionized factories were obsoleted by globalization, and cheap overseas labor, hollowing out this tax base of laborers. Western governments needed a new tax base, but failed to find one. Instead, they responded by printing the money they needed, with the hope that technological disinflation, and increased globalization would offset the inevitable inflation of printing money, while the taxes upon asset inflation would solve the budget deficits. Unfortunately, we’ve hit a stall-speed on this process. In 2023, total government spending was approximately 33%, while in places like France, it has increased to 58% of GDP (IMF). The number can indeed go higher, in the Soviet Union it was effectively 100%. However, there are rapidly diminishing returns to this process. At the same time, Western Governments have made hundreds of trillions of unfunded promises to their citizens. Normally, governments would simply raise the tax rate, to plug the accelerating budget deficits, but they’ve encountered a problem.

You see, the nature of wealth has evolved once again. No longer is fertile acreage the primary source of wealth in a developed nation—nor is it the factory or the teeming masses of laborers. Instead, increasingly, wealth is expressed in the form of knowledge and intangibles, as opposed to sedentary assets. Wealth is now made up of patents, highly-specialized job skills, computer code, public securities and crypto-currency. Those with wealth can simply pick up when they don’t enjoy the rules. This has been an ongoing trend for many decades, but it’s been accelerating in the past few years. Previously, you needed to be near a big city, and close to business contacts. There were network effects that made certain cities into meccas for certain industries. You were an outcast if you fled, and your earning capacity declined inversely with your proximity to where your industry was located—besides, the amenities in many tax havens were severely lacking. That has mostly been negated by technology. Video calling is more efficient than a 3-hour lunch, and it connects you instantly. Data is ubiquitous; you no longer have to sit in a conference hall to learn a unique factoid. Your business relationships are just as likely to be mobile as you are. The world has changed, but the Socialist taxing state hasn’t considered this possibility. If anything, they’re choosing to tax the productive class even harder.

This has now set up what I now see as a mega-trend. The peasants are along for the ride, wherever Socialism takes them. However, the 0.1% have flexibility, and they’re increasingly fleeing. Given the exponentiality of it, it’s becoming a crisis—the 0.1% refugee crisis. Interestingly, while home countries continue to turn up the heat on their most productive citizens, dozens of locales are instead fighting for the most productive global citizens. Most places are already offering zero as the tax rate, so the competition isn’t over taxes, but intangibles like quality of life, amenities, reduced regulatory burden, specialized industry hubs, and the capacity to network and grow your business. The fight over the world’s most productive citizens is fierce, with expensive and highly targeted marketing campaigns, along with bespoke special deals, for the truly desirable.

As the social stigma dissipates and the business functionality of certain locations improves, what started as a trickle, has become a tidal wave. While taxes may be a driving factor, it does seem that every wave of home governments overreach has led to another wave of 0.1% refugees—particularly as many home governments initiate wealth taxes, and degrade the quality of life through open borders and increased rates of crime. Why pay more for less?? Why pay when your country no longer feels like your country?? Why pay when you disagree with the current trajectory?? Why support them when they hate you?? Why not leave?? What happens when your friends are also leaving?? I see this as a Mega-Trend, especially as the inevitability of exit taxes and currency controls dawns on the 0.1%, further accelerating the trend. I want to get long the 0.1% refugee crisis.

My original exposure to this trend was during 2020 when the beaches in Miami locked down for Covid, yet the Panhandle laughed at the hysteria and remained open—welcoming everyone. While my wife and I merely rented a place for the month, we saw property prices scream higher as others chose to move to one of the prettiest parts of America, in a state with zero state income taxes. At the time, the shares were in the low $20s. The shares have done quite well since then, though I genuinely believe that the shares have still under-performed the rapidly improving fundamentals of the business—especially as the Panhandle hits a critical mass, dramatically improving the quality of life. Now, I’m on a mission to find the next JOE.

A few months back, I spent several days in Grand Cayman. I hadn’t been there in nearly a decade, and was amazed at how far it had advanced since I was there previously. I regret not buying a place there—it would have been a home run investment. I was in Andorra for New Years last year, that place is absolutely booming. The same goes for Malta, where I spent a week in January of 2023. There is a universality to all these places; low taxes, a carefree lifestyle, a shared community of others who have expatriated, and a desire for a better life, free from the crime and degradation of the Socialist places they fled.

After college, I could have returned to New York, but chose Miami instead. At the time, everyone I knew thought I was a fool. You needed to be in New York to go to IPO roadshows and analyst lunches. Besides, all the smart guys doing interesting stuff were up there. I used to commute from Miami and spend a week a month in New York. However, over time, more guys moved to Miami and New York was hollowed out. Now Southern Florida is the capital of Western Finance, most of the guys doing creative stuff are there. Meanwhile, New York is increasingly becoming a back office for clearing trades and IPOs. It takes a certain critical mass, but then a rivulet becomes a river. I saw it happen over two decades in Miami, and I see it happening in many other locales. Who could have ever imagined what Dubai has become?? I’m still amazed at how much JOE has built, and how much more desirable it has become, since I first visited in 2018.

I want to get long this Mega-Trend, and do it through a diversified basket. There are so many ways to ‘play’ this trend; from property companies, to financial institutions—from public companies to private ones. I feel like many of these prime jurisdictions are just hitting critical mass now, and about to enter the exponential phase. I can imagine a world that looks VERY different from the world of the past few millennia, because wealth is now mobile—successful people want to be with other successful people and away from the inevitable chaos as their home countries are undermined from within. Sure, they’ll go back and visit. They’ll be welcomed with open arms as they spend money—but their home bases will be in these 0.1% refugee capitals, even if some of their assets are stranded in the home country, with elevated taxes on those discrete assets.

I’ve invested a lot of mental capital in this theme, but unfortunately, I’ve come up with only a few ticker symbols. I want to get long, but long what??

In something of a first for this site, I’m going to host a shared Happy Hour chat with 0.1% refugee Swen Lorenz. I’ve read Swen for years, and taken his ethos to heart. Very few have spent as much time thinking and writing about the opportunities of expats overseas. We’re going to discuss this 0.1% refugee crisis Mega-Trend, along with sharing a few ticker symbols that we’ve both discovered. We’re also going to get an update on his plans for Sark, including a company that I hope to invest in, and join as a board member. Following our chat, we’re going to open the conversation up to anyone with a question about Sark or any other topic tied to this Mega-Trend.

If you’d like to participate in our Zoom call on August 23rd, click this link to register, then grab a beverage and get ready to ask questions.

Click here to register for the live and interactive Happy Hour on August 23rd

Disclosure: Funds that I control are long JOE